PSR develops a generation expansion portfolio analysis project in partnership with EPE

In August, PSR finalized the project “Analysis of Power Generation Expansion Portfolios”, in partnership with the Energy Research Company (EPE). The project was made possible through Brazil-Germany Technical Cooperation, together with GIZ (Deutsche Gesellschaft für internationale Zusammenarbeit), a German agency which fosters international development cooperation.

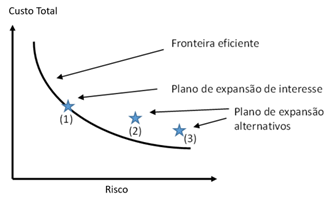

One of the objectives of the project was the delivery of a tool for analyzing the efficiency of power generation portfolios from the “risk versus return” point of view. The application consists of calculating the efficient frontier (a set of different optimal generation expansion plans) taking into account the relationship between the total cost of generation and the volatility associated with this cost, as well as identifying the position of the results of the Ten-Year Energy Expansion Plan (PDE) in relation to the efficient frontier.

In the specific context of evaluating expansion plans, risks are associated with unexpected increases in costs that may be incompatible with the expected cost of investment/operation. The total elimination of risks in the preparation of an expansion plan may be associated with a high investment/operation cost, and may even make it impractical. On the other hand, the acceptance of some level of risk may imply a considerable decrease in the expected value of the investment/operation cost.

For example, imagine a system in which there is, sporadically, very high peak demand. The cheapest way to meet this end can be with a diesel thermal plant, with low CAPEX and high OPEX, but little use. This would lead to a large variance. If variability is not desired, an alternative to mitigate this volatility would be to install a large number of plants from intermittent renewable sources, at a high investment cost, to guarantee service even in this case at low costs; however, with high renewable energy spills in more frequent scenarios/moments. In summary, note that in order to reduce volatility and associated risks, it is necessary to pay higher costs. Therefore, it is up to the planner to calibrate their risk tolerance level and willingness to pay higher costs to mitigate them.

In addition, this project also included the delivery of the OptDec tool to the EPE. OptDec is a computational model that allows the comparison of different expansion plans, based on attributes defined in different future scenarios, under varying evaluation criteria.

“The tooling delivered under this project will make it possible to quantify the trade-off between total costs and associated risks of different generation expansion portfolios. And we hope it will help EPE in its future analyses and evaluations, especially during the elaboration of the Ten-Year Expansion Plans”, says Ricardo Perez, team leader of Optimization and Analytics at PSR.